Home > Solution > FinRecon

Optimize Financial Ecosystem & Enhance Productivity Effortlessly With FinRecon

Home > Solution > FinRecon

Optimize Financial Ecosystem & Enhance Productivity Effortlessly With FinRecon

Transforming Financial Challenges With FinRecon’s Streamlined Approach & Automated Solutions

Reconciliation inefficiencies create a ripple effect that affects every part of the financial ecosystem. CFOs, finance teams, auditors, and regulators all bear the consequences when outdated systems are in place.

Manual & Error-prone

Finance teams spend half their time on manual spreadsheets, leading to errors and misstatements

Time-consuming

Relying on manual staff over automation cuts efficiency, delaying period closings and decisions

Transaction Matching

Transaction matching removes discrepancies, boosts accuracy, and accelerates reconciliation.

Operational Struggle

Limitations obstruct scaling and compliance as businesses grow, expanding operations

High Penalties

Errors and delays in financial systems lead to audits, fines, and damaged reputation.

Resource Strain

Excessive manual effort on financial tasks reduces productivity, strains staff, and increases burnout risk.

Data Blind Spots

Not detecting data discrepancies raises fraud exposure, operational risks, and legal consequences

Reputational Damage

Incorrect reporting harms reputation,trust, and results in lost opportunities, confidence

Transform Reconciliation Process With FinRecon for Faster Decision making & Better Accuracy

Reconciliation inefficiencies create a ripple effect that affects every part of the financial ecosystem. CFOs, finance teams, auditors, and regulators all bear the consequences when outdated systems are in place. Without a modern financial reconciliation software solution like FinRecon, organizations face costly compliance penalties, resource strain, data blind spots, and reputational damage, all of which undermine growth, efficiency, and profitability.

Reputational Damage

Inaccurate or delayed financial reporting can severely damage an organization’s reputation, eroding stakeholder trust and potentially resulting in lost business opportunities and decreased investor confidence.

Resource Strain

Relying on excessive manual effort to handle financial tasks not only reduces overall productivity but also places unnecessary strain on staff, impacting morale and increasing the likelihood of burnout.

Data Blind Spots

Failure to identify anomalies or discrepancies in data can result in missed opportunities to detect fraud or other operational risks, putting the organization at greater exposure to financial and legal repercussions.

Costly Compliance Penalties

Errors and delays in financial processes often trigger audit findings, leading to significant fines and penalties that can harm the organization’s financial standing and reputation.

Reputational Damage

Inaccurate or delayed financial reporting can severely damage an organization’s reputation, eroding stakeholder trust and potentially resulting in lost business opportunities and decreased investor confidence.

Resource Strain

Relying on excessive manual effort to handle financial tasks not only reduces overall productivity but also places unnecessary strain on staff, impacting morale and increasing the likelihood of burnout.

Data Blind Spots

Failure to identify anomalies or discrepancies in data can result in missed opportunities to detect fraud or other operational risks, putting the organization at greater exposure to financial and legal repercussions.

Costly Compliance Penalties

Errors and delays in financial processes often trigger audit findings, leading to significant fines and penalties that can harm the organization’s financial standing and reputation.

Resource Strain

Relying on excessive manual effort to handle financial tasks not only reduces overall productivity but also places unnecessary strain on staff, impacting morale and increasing the likelihood of burnout.

Reputational Damage

Inaccurate or delayed financial reporting can severely damage an organization’s reputation, eroding stakeholder trust and potentially resulting in lost business opportunities and decreased investor confidence.

Data Blind Spots

Failure to identify anomalies or discrepancies in data can result in missed opportunities to detect fraud or other operational risks, putting the organization at greater exposure to financial and legal repercussions.

Costly Compliance Penalties

Errors and delays in financial processes often trigger audit findings, leading to significant fines and penalties that can harm the organization’s financial standing and reputation.

Empowering CFO teams with

End - to -End Digital Transformation

Achieve Real-time Financial Clarity & Precision Through FinRecon

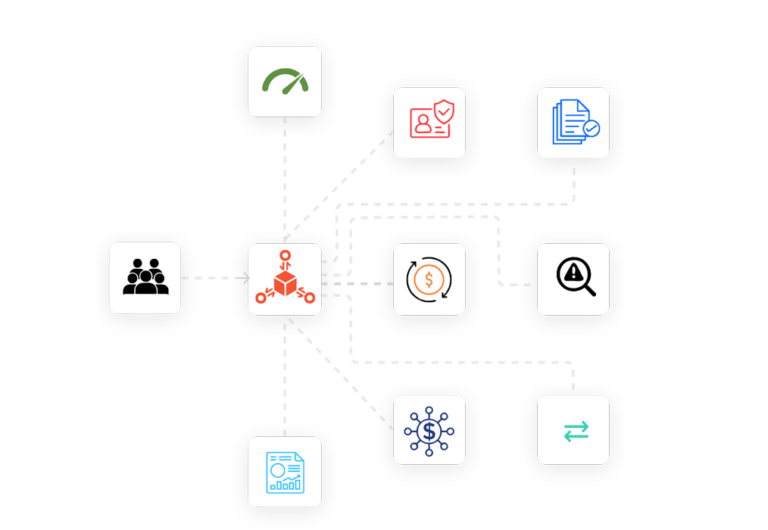

FinRecon leverages AI to streamline and automate reconciliation processes, eliminating manual errors and inefficiencies. Accelerating financial operations, it ensures greater accuracy and timely insights.

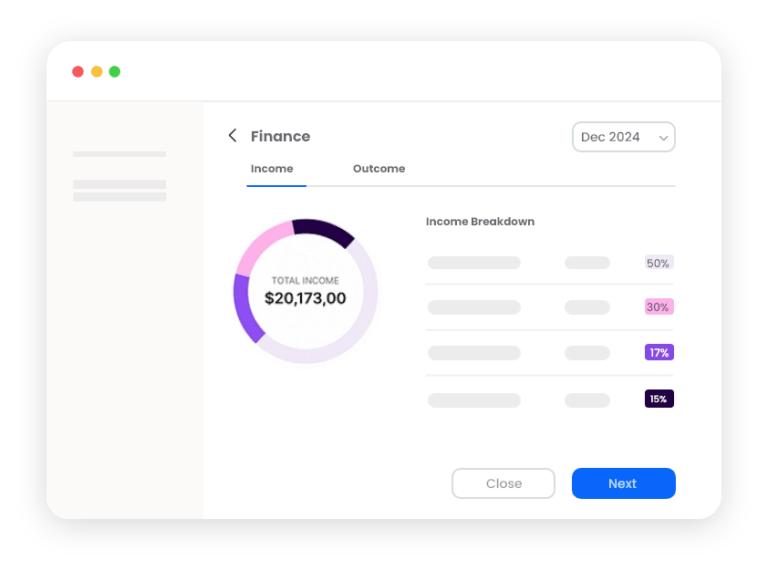

Unified Financial Insights

Streamline financial data integration across various systems, ensuring accurate and unified financial reporting without discrepancies.

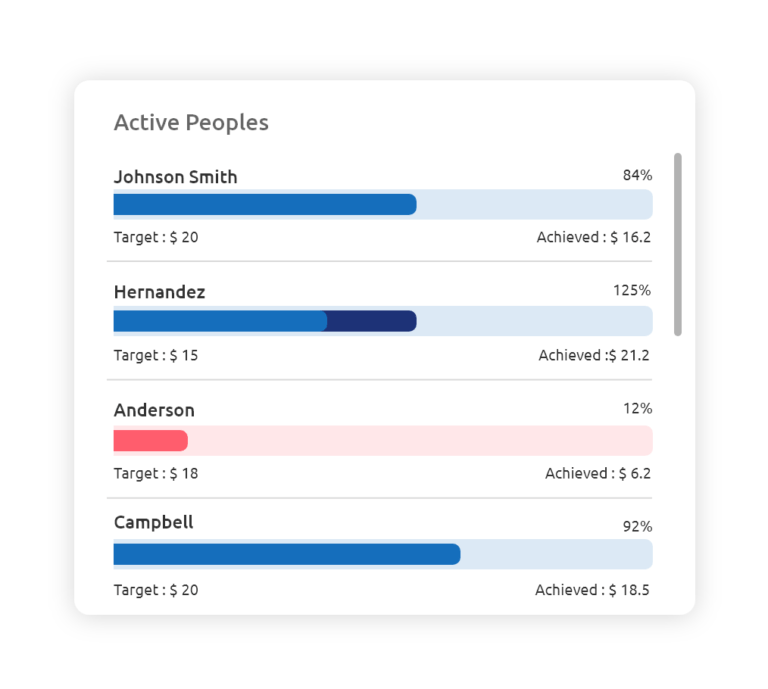

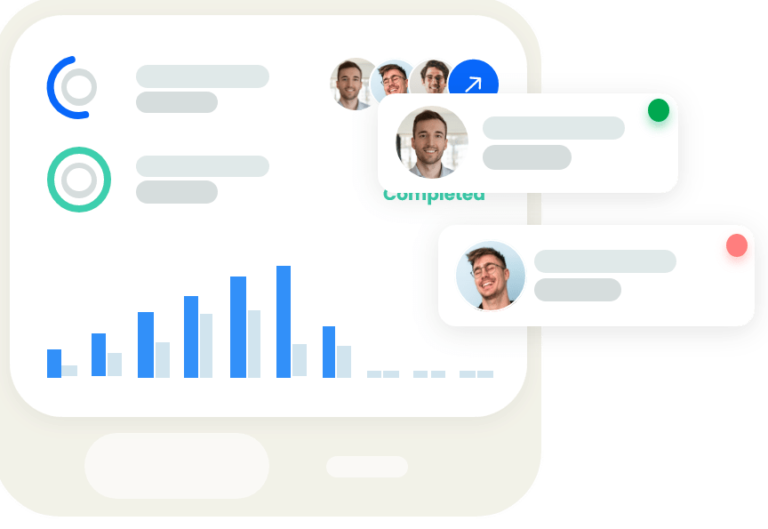

Empower Team Growth

Free up finance teams from routine tasks to focus on high-value activities like forecasting and risk management.

Seamless Workflow Automation

Seamlessly integrate and automate financial tasks across multiple applications, enhancing collaboration and efficiency.

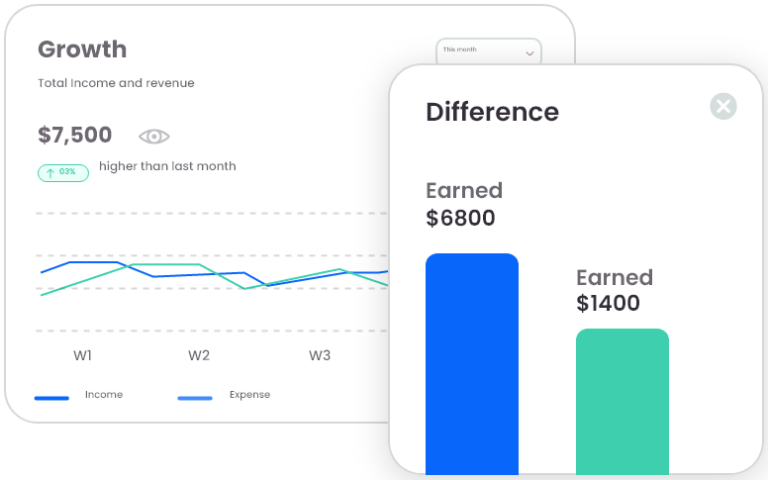

Real-Time Data Visualization

Customize dashboards and reports for real-time, insightful tracking of financial activities, enabling faster decision-making.

Error-Free Reconciliation

Automate journal entries and reconciliations while ensuring

seamless transaction matching, eliminating manual errors and discrepancies for accurate financial reporting.

Set Your Finances on the Path to the Future Powered by FinRecon

Solve current challenges while ensuring your financial processes are prepared for the demands of tomorrow. Boost scalability, efficiency, and accuracy with our advanced reconciliation software for finance.

Accelerated Closings

Cut financial closing times by 50% for more timely reporting.

Enhanced Accuracy

Improve data reliability by 90%, ensuring seamless audits and regulatory compliance.

Cost Savings

Reduce operational costs by 30% through minimized manual effort and optimized resources.

Scalability and Flexibility

Adapt to changing transaction volumes and regulatory updates without skipping a beat.

Strategic Focus

Free up your finance team to focus on high-value tasks like risk management and forecasting.

Long-Term Resilience

Build a strong financial foundation to withstand uncertainties, regulations, and technological advancements

Why Choose FinRecon?

FinRecon is more than a tool—it’s a partner in your financial transformation, designed to empower businesses with:

Future-Driven Capabilities

Sophisticated AI and predictive analytics ensure you’re always one step ahead.

Streamlined Operations

Unlock the potential of automation to deliver faster, smarter, and more reliable financial insights.

Resilient Compliance

Built to align with the evolving regulatory landscape, minimizing risks and maximizing trust.

Experience the future of automated financial reconciliation today with FinRecon.

Let’s make your financial processes effortless, accurate, and scalable. Contact us to learn more!

Contact

+1 786 756-6276

You can also email us directly at

contactus@10decoders.com

Contact us