AML/KYC Compliance Designed Around Your Business

Customize your Know Your Customer (KYC) and Anti-Money Laundering (AML) operations with 10decoders to align with evolving global regulations built your way, ready for both present and future compliance needs.

Streamline Compliance with Intelligent Automation

Stay Compliant Today - and Tomorrow

Automate AML/KYC workflows and adapt effortlessly to new regulatory updates using 10decoders no-code compliance platform built for flexibility and scale.

Build a Dynamic, Risk-Based Framework

Take a personalized, adaptable, and scalable approach to user risk with a configurable system designed to fit your organization’s compliance strategy.

Minimize Manual Work and Data Silos

Simplify reviews, audits, and regulatory filings by consolidating identity data and AML/KYC operations within a single, secure environment.

Create AML/KYC Processes That Work Seamlessly for Teams, Customers, and Auditors

Advanced and Transparent Compliance Controls

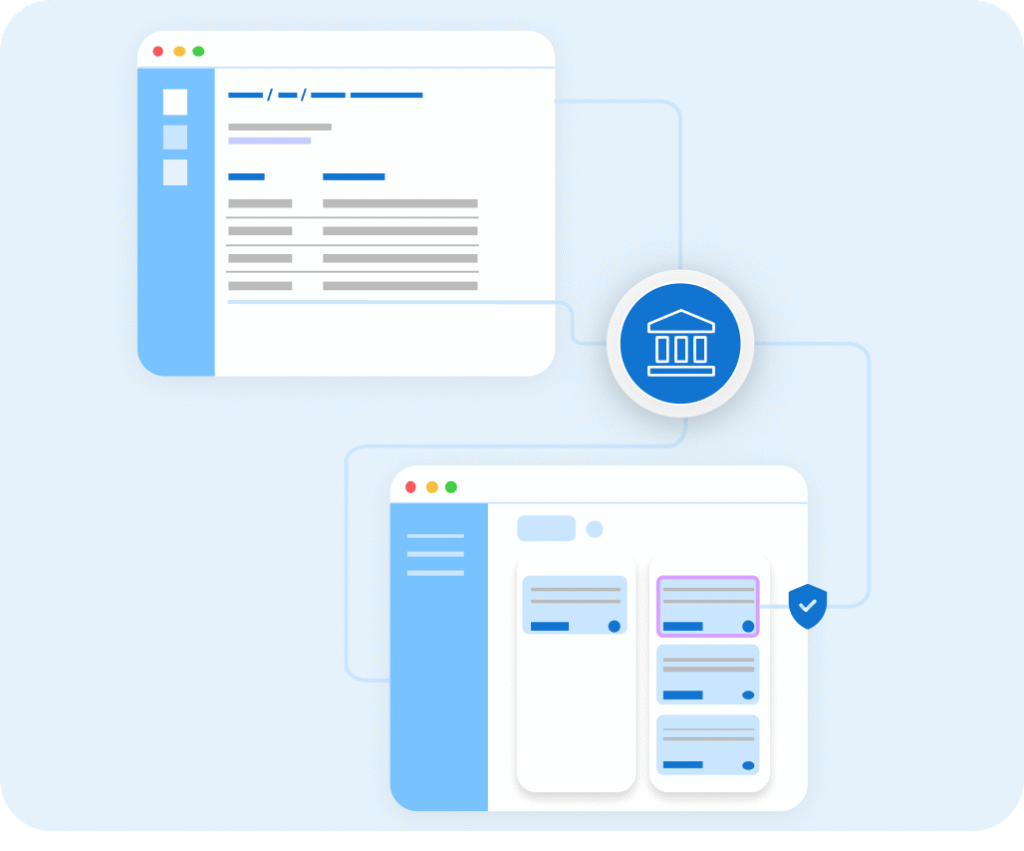

Customize your AML/KYC workflows end to end, from verification and screening requirements to match thresholds. Stay audit-ready with clear, trackable compliance logs and unified customer profiles all without depending on engineering resources.

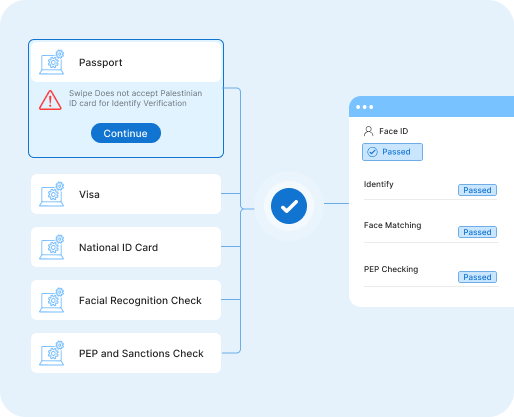

Frictionless End-User Experience with Intelligent Risk Routing

Deliver a branded, smooth verification journey that meets AML standards while adapting in real time to user geography, activity, and risk category. Approve genuine customers quickly while identifying fraudulent or suspicious behavior with ease.

Manage Everything from a Unified Compliance Hub

Bring together identity data, investigations, and regulatory workflows in one centralized view. Automate SAR/STR filings, streamline decision-making, and maintain a complete audit trail, all from a single pane of glass.

Everything You Need to Power Your AML/KYC Operations

Know Your Customer (KYC) / Know Your Business (KYB)

Individual and Business Verification

Verify both individuals and corporate entities including Ultimate Beneficial Owners (UBOs) through a single integrated platform.

Documentary Verification

Authenticate official government IDs from 200+ countries and business records such as incorporation papers, licenses, and partnership agreements.

Smooth Verification Experience

Deliver user-friendly KYC/KYB verification flows that meet international compliance standards while offering a seamless experience for your customers.

Non-Documentary Verification

Validate personal and company data against authoritative databases, digital identity systems, and online registries. Perform enhanced due diligence using SoS and global registry screenings.

Deploy Verification When It Matters

Launch verification flows dynamically during onboarding, account recovery, or whenever high-risk activity occurs to prevent fraudulent access.

Identity and Device Linking

Enhance security with selfie liveness detection, video KYC, and two-factor device authentication to prevent spoofing, deepfakes, and identity theft.

Individual and Business Verification

Verify both individuals and corporate entities including Ultimate Beneficial Owners (UBOs) through a single integrated platform.

Documentary Verification

Authenticate official government IDs from 200+ countries and business records such as incorporation papers, licenses, and partnership agreements.

Smooth Verification Experience

Deliver user-friendly KYC/KYB verification flows that meet international compliance standards while offering a seamless experience for your customers.

Non-Documentary Verification

Validate personal and company data against authoritative databases, digital identity systems, and online registries. Perform enhanced due diligence using SoS and global registry screenings.

Deploy Verification When It Matters

Launch verification flows dynamically during onboarding, account recovery, or whenever high-risk activity occurs to prevent fraudulent access.

Identity and Device Linking

Enhance security with selfie liveness detection, video KYC, and two-factor device authentication to prevent spoofing, deepfakes, and identity theft.

Continuous Screening and Monitoring

Continuously check individuals, entities, and businesses against global sanction lists, politically exposed persons (PEPs), and negative media databases.

Custom and Private List Screening

Upload and monitor against private, regulatory, or internal watchlists including FinCEN 314a and other non-public databases with scheduled or recurring screenings.

Comprehensive and Transparent Controls

Reduce false positives with granular match configuration and full control over screening logic. Investigate hits efficiently with unified identity views and a clear audit trail for regulators.

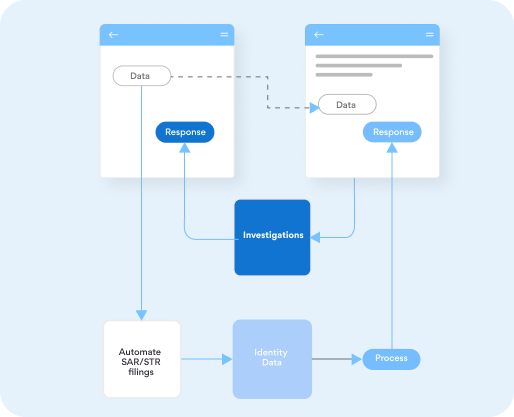

Automated Due Diligence and Reporting

Rules-Based Automated Decisioning

Reduce manual investigations using configurable, no-code automation that aligns with your company’s specific risk-based approach.

Consolidated Case Management

View all user data including related identities, linked accounts, and historical activities in a single customizable case dashboard to make faster, better decisions.

Automated SAR/STR Filings

Auto-generate comprehensive Suspicious Activity Reports (SARs) and Suspicious Transaction Reports (STRs) with complete identity context, and submit them directly to relevant regulatory bodies.

How It Works

Configure

Start by defining your AML/KYC workflows with 10decoders no-code platform. Set up verification types, risk rules, screening logic, and regulatory triggers that align perfectly with your business model and compliance framework.

Orchestrate

Connect every compliance touchpoint from onboarding and verification to continuous screening through a single orchestration layer. Integrate with APIs, identity databases, and external systems to keep your compliance flow seamless and scalable.

Decide

Use intelligent decision engines to automatically evaluate user risk, document authenticity, and screening results. Apply configurable rules to approve, escalate, or decline cases based on real-time data and regulatory thresholds.

Monitor

Continuously track user activity, risk patterns, and regulatory updates. Get alerts for suspicious behavior, automate ongoing screenings, and maintain complete audit visibility — ensuring your organization always stays compliant and audit-ready.

How It Works

Configure

Start by defining your AML/KYC workflows with 10decoders no-code platform. Set up verification types, risk rules, screening logic, and regulatory triggers that align perfectly with your business model and compliance framework.

Orchestrate

Connect every compliance touchpoint from onboarding and verification to continuous screening through a single orchestration layer. Integrate with APIs, identity databases, and external systems to keep your compliance flow seamless and scalable.

Decide

Use intelligent decision engines to automatically evaluate user risk, document authenticity, and screening results. Apply configurable rules to approve, escalate, or decline cases based on real-time data and regulatory thresholds.

Monitor

Continuously track user activity, risk patterns, and regulatory updates. Get alerts for suspicious behavior, automate ongoing screenings, and maintain complete audit visibility — ensuring your organization always stays compliant and audit-ready.

Industries We Support

Digital Banks and Neobanks

Cryptocurrency and Web3 Platforms

Money Transfer and Remittance Companies

Financial Institutions

Online Payment Gateways and Wallets

Lending and Buy-Now-Pay-Later Providers

Explore More from 10decoders Identity and Compliance Suite

Discover how 10decoders helps you automate identity verification and compliance workflows with precision and global coverage.

Screen Customers Against Global Sanctions, PEP, and Watchlists

Mitigate compliance risks proactively through real-time screening of customers against global watchlists and PEP data.

Verify Global Government IDs and Business Documents

Authenticate customer and business identities in seconds using AI-driven document verification worldwide.

Ready to Elevate Your Compliance Operations?

Talk to our experts or experience 10decoders AML/KYC compliance solutions firsthand.

Trusted by the World's Leading Companies

Awesome to work with. Incredibly organized, easy to communicate with, responsive with next iterations and beautiful work. The team is very agile and is available when you need them. Not only they provide quality deliverables but also they have a great sense of ownership.

Dan Castillo

CEO & Founder

10Decoders are great! If you’re looking for a reliable partner to support your development needs, look no further! Thomas and Supriya will make sure you have reliable and talented developers assigned, and they will track your project from start to finish. If you have any issues, they are ALWAYS available. You won’t be disappointed.

Frank

CEO & Founder

The 10decoders team is always willing to go the extra mile for our team and our clients. They frequently assist us with last minute requests and questions, helping us give our clients the best service.

Lee

CEO & Founder

I have been working closely with 10decoders for more than a year now and am really satisfied with the quality of the IT Services they produce. The team shows great sense of responsibility and are committed to their work. They are flexible and adapt quickly to the demands of the team. Great

Basker Manivanan

CEO & Founder

What a great team to work with . They did not only work and deliver the defect free code on time but they went an extra mile and setup some process improvements which not only helped us delivering on time but helped tracking defect code with all the standards followed . Right from document

Ravi

CEO & Founder

Our Recent Blogs

Contact Us